The AI researchers identified a surge on July 26, 2025 in malicious applications impersonating prominent financial institutions, launching a wave of phishing apps aimed at stealing customer login information. Victims across multiple countries reported unauthorized transactions within hours of installing the fake software, calling attention to a spike in banking fraud facilitated by stealthy cyber crimes.

How the Fake Banking Apps Infiltrated Mobile Stores

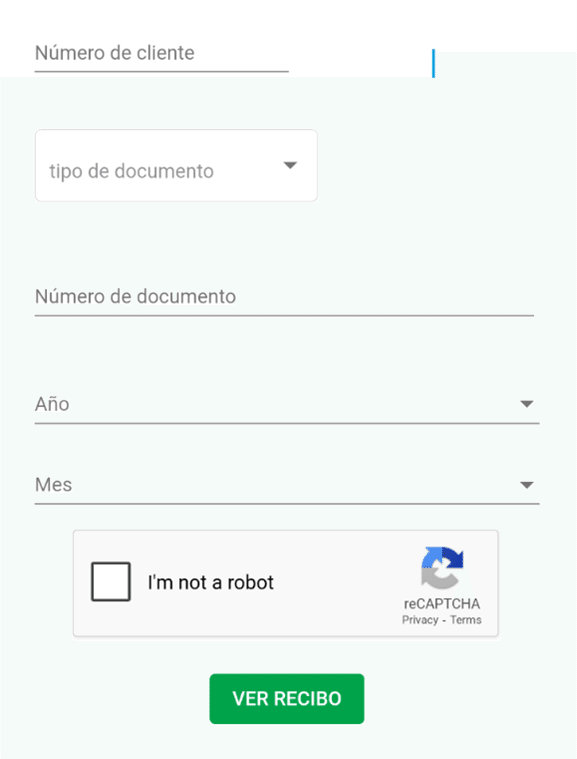

On July 26, 2025, cybercriminals deployed dozens of malicious apps posing as official mobile banking clients in mainstream app stores and third-party marketplaces. These apps bore near-identical branding, using bank logos, screenshots, and descriptions nearly indistinguishable from authentic applications. Once installed, the apps prompted users for login credentials, two‑factor authentication codes, and even biometric verification under the guise of device security checks.

Within hours of installing the apps, users began noticing unusual transactions, missing funds, or locked accounts. Analysts confirmed that these phishing apps transmitted stored and entered credentials to command‑and‑control servers, effectively fueling widespread banking fraud. Mobile malware strains used in the campaign demonstrated heightened sophistication by detecting environment sandboxes and hiding inside decrypted payloads.

Fake form inside the app (Source: kasperky.com)

Detection and Forensic Findings

Security firms tracing the attacks to a centralized campaign leveraging supply chains of cloned or compromised app repositories. The malware employed obfuscation layers, dynamically loaded modules, and dummy credentials to evade static signature scans. In several cases, forensic investigators recovered partial logs linking malware servers to IP addresses known for hosting phishing domains.

Organizations issuing warnings advised users to verify apps only via official app stores and to confirm developer names. Several banks published security bulletins stating that no official application was compromised and to be wary of lookalike versions.

Implications for Consumers and Financial Institutions

This recent wave of fake apps underscores how cyber crimes have evolved into multi‑platform threats. Unlike typical phishing schemes relying on emails or SMS, mobile malware campaigns leverage the trust in app stores to bypass user suspicion. Victims lose not only access to funds but also suffer identity theft, unauthorized credit applications, and long-term credit damage.

Banks face reputational risk as customers fall victim, even if the institution’s own systems remain secure. Regulatory scrutiny may also increase, with compliance bodies questioning why such apps were allowed to flourish before takedown.

Emerging Trends in Banking-Related Mobile Malware

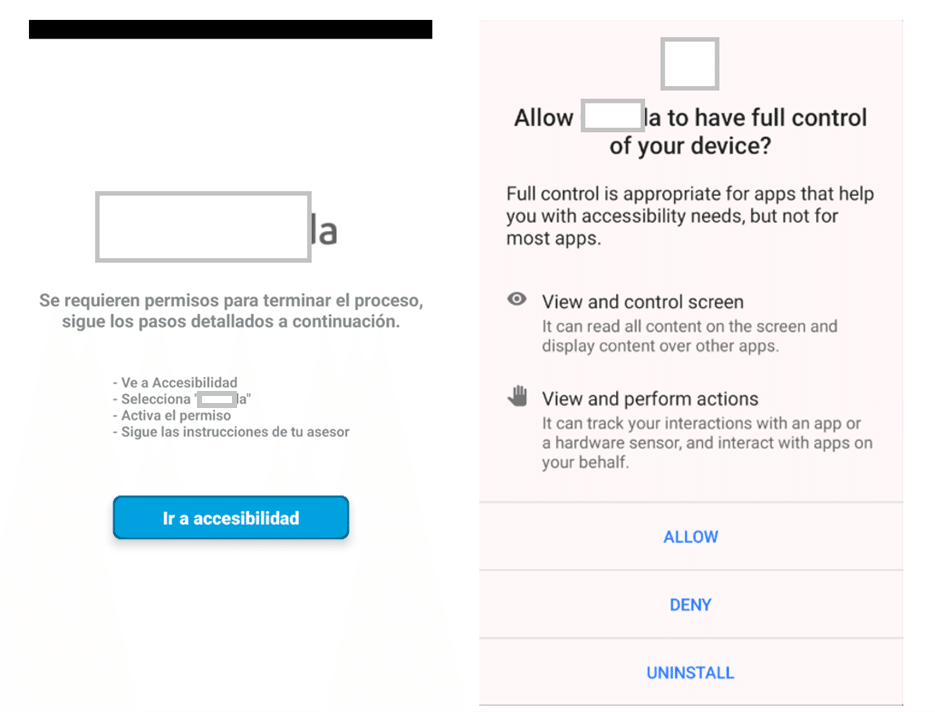

Cybersecurity analysts observe a trend toward phishing apps that integrate with existing banking workflows. Advanced strains now request biometric access pretending to optimize security, while others overlay fake interfaces on legitimate apps using accessibility services. These tactics make detection more difficult for casual users.

Malicious app requesting accessibility permissions (Source: kaspersky.com)

Cybersecurity Considerations

The July 26 incident highlights that banking fraud is no longer confined to phishing emails or ATM skimming; mobile platforms are now prime attack surfaces. Regulators, banks, and third parties must collaborate to share indicators of compromise, takedown methods, and technical signatures to remove fake apps swiftly.

Consumer trust in mobile banking may erode if these trends continue—potentially slowing adoption and increasing reliance on offline channels. Maintaining vigilance and rapid response systems is essential in the face of evolving cyber crimes targeting mobile financial credentials.

The surge of phishing apps impersonating banking software on July 26, 2025 marks a notable escalation in mobile-oriented banking fraud and broader cyber crimes. As fake apps grow more sophisticated, organizations and users must elevate vetting, behavioral detection, and education strategies. Combating these threats demands proactive intelligence, stronger defenses, and coordinated industry action.